new hampshire sales tax on vehicles

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New Hampshire also has several excise taxes such as a tax on lodging and business taxes.

The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes.

. Most of the information contain in Auto Leasing applies equally to other types of consumer product leases. The Consumer Leasing Act also applies to consumer product leases in addition to vehicles. So when it comes to registering your vehicle in NH you will not pay any sales tax.

A 9 tax is also assessed on motor vehicle rentals. The sales tax ranges from 0 to 115 depending on which state the car will be registered in. New Hampshire is one of the few states with no statewide sales tax.

If the sale is made by a motor vehicle or trailer dealer or lessor who is registered the sales tax rate is 625. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. 11 - What is the 2022 New Hampshire Sales Tax Rate.

New Hampshire also has a timber tax. Motor Vehicle Hearings have resumed in-person hearings or you may elect to appear by telephone or video conference by calling 603 271-2486 or emailing safety-hearingsdosnhgov before the day of the hearing to provide contact information. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states.

However vendors in New Hampshire must register for other states sales taxes and collect taxes on retail sales when required by the other states. NH is also one of the few states that doesnt charge a sales tax on vehicle purchases. Is New Hampshire A Tax-Friendly State For Retirees.

In addition to the registration fees there is an 800 plate fee for the first time you order plates. The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more. Although walk-in services are available customers with an appointment will be given priority.

If you are legally able to avoid paying sales tax for a car it will save you some money. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. Are there states with little to no sales tax on new cars.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Property taxes that vary by town Auto registration fees A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. Nearly every state in the US implements a sales tax on goods including cars.

The Current Use Board is proposing to readopt with Amendment Cub 30503 Cub 30504 -Assessment Ranges for Forest Land Categories With and Without. New Hampshire has a 0 statewide sales tax rate and does not allow local. Because registering a vehicle in New Hampshire is a two-part process there are fees due to both the towncity and to the State.

The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. I traded a car for another car and now I cant register the car that I got New Hampshire 3 replies Property Taxes and other taxes New Hampshire 23 replies Paying taxes in NH New Hampshire 14 replies Insurance Cost of Living Taxes Car Inspections New Hampshire 19 replies Questionable value for your property taxes New Hampshire 11.

New Hampshire does not have a sales tax on sales of goods in the state. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. 11 - What is the 2022 New Hampshire Sales Tax Rate.

000 2022 New Hampshire state sales tax Exact tax amount may vary for different items The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. No income tax No sales tax No capital gains tax No inheritance or estate taxes New Hampshire does collect. New Hampshire is one of the few states with no statewide sales tax.

Neither the federal nor New Hampshire laws cover the leasing of real estate or housing or rent-to-own agreements. For an explanation of fees please see RSA 261141 for state fees and RSA 261153 for towncity fees. New Hampshire may not have a car sales tax rate but there are still additional fees to be aware of.

New Hampshire DMV Registration Fees 18 per thousand for the current model year 15 per thousand for the prior model year. While states like North Carolina and Hawaii have lower sales tax rates below 5. However New Hampshire is one of five states that doesnt have any sales tax whatsoever.

As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on Monday April 18 2022. That means you only pay the sticker price on a car without any additional taxes. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

This is imposed at the time the tree is cut at 10 the value of the wood. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055. 000 2022 New Hampshire state sales tax Exact tax amount may vary for different items The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

The registration fee decreases for each year old the vehicle is. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you purchase a used Honda Civic for 10000 you will have to pay an.

The sales tax applies to transfers of title or possession through retail sales by registered dealers or lessors while doing business. While New Hampshire does not charge vehicle sales tax they still have DMV fees. For example sales tax in California is 725.

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

New Hampshire Motor Vehicle Bill Of Sale Form Modeles Echantillons Remplissables Et Imprimables Pour Pdf Word Pdffiller

Used Cars In New Hampshire For Sale Enterprise Car Sales

Price Jump For Used Cars Results In Boost In Iowa Sales Tax Collected Iowa Thecentersquare Com

What States Charge The Least Most In Car Taxes Carvana Blog

Alaska Vehicle Sales Tax Fees Find The Best Car Price

Alaska Vehicle Sales Tax Fees Find The Best Car Price

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Car Sales Tax In Ohio Getjerry Com

New Hampshire Motor Vehicle Bill Of Sale Form Modeles Echantillons Remplissables Et Imprimables Pour Pdf Word Pdffiller

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Alaska Vehicle Sales Tax Fees Find The Best Car Price

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

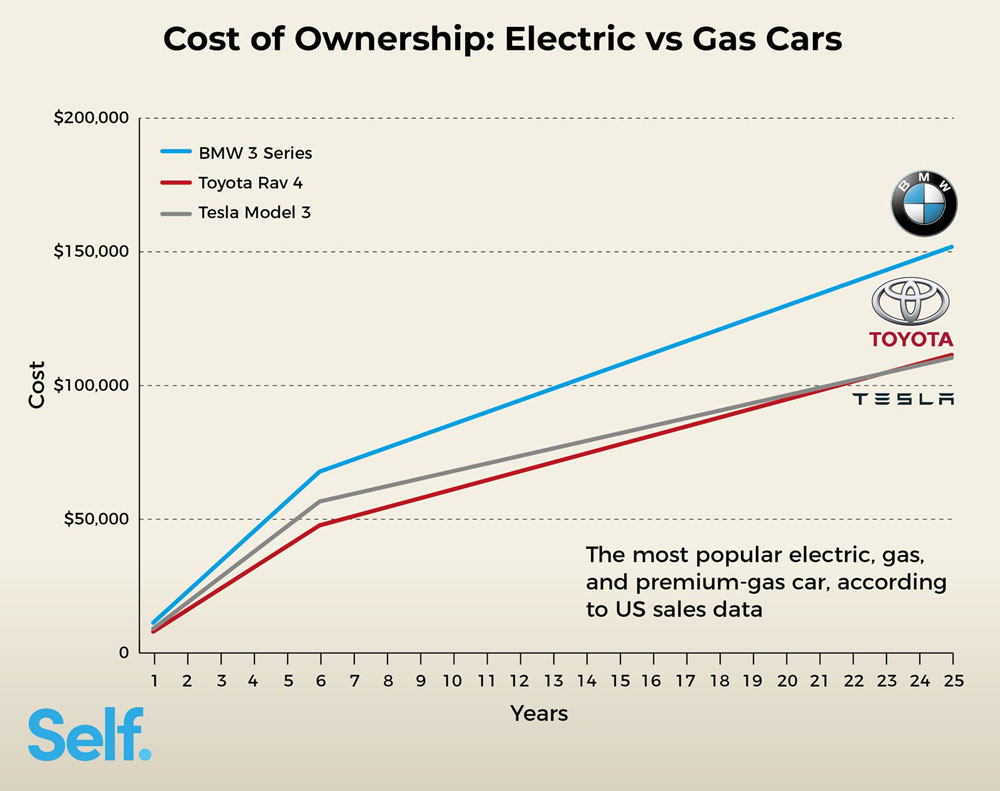

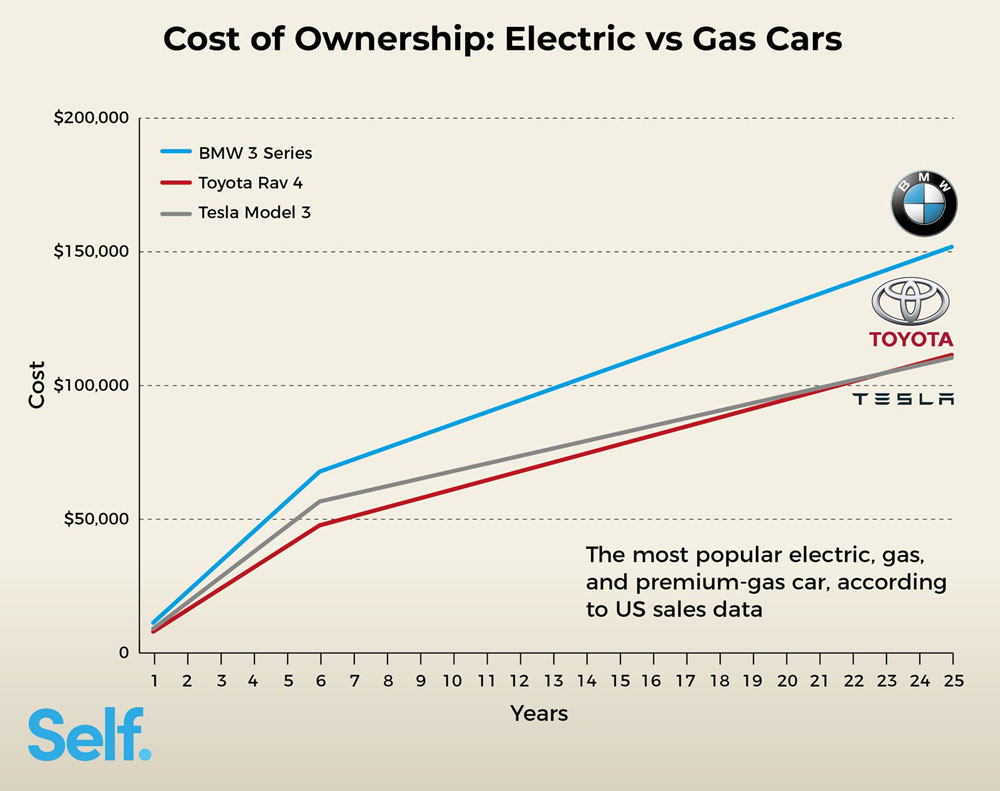

Electric Cars Vs Gas Cars Cost In Each State Self Financial

What States Charge The Least Most In Car Taxes Carvana Blog