texas tax back dallas

Texas tax liens are offered for sale by the counties once each month. This program is designed to help you access property tax information and pay your property taxes online.

Dallas Tax Attorneys Tax Attorney Tax Refund Tax

Like the rest of Texas this is much higher than the national average since you dont pay income taxes.

. Your average tax rate is 169 and your marginal tax rate is 297. If you make 55000 a year living in the region of Texas USA you will be taxed 9295. Texas Tax Back located at The Galleria.

You may also visit one of our many convenient Tax Office locations. Dallas County TX currently has 2093 tax liens available as of February 16. 214 653-7811 Fax.

Did South Dakota v. That means that your net pay will be 45705 per year or 3809 per month. Texas has been referred to as a hybrid tax deed state because its laws provide homeowners with an opportunity to pay delinquent taxes for a period of time after a winning bidder takes possession of the countys tax lien against the property.

In Texas even though you may hear of a sale referred to as a Texas Tax Lien Sale a buyer is not buying a lien but is actually buying the deed to a property at a Sheriff Sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Dallas County TX at tax lien auctions or online distressed asset sales. 256 rows Texas Sales Tax.

However cities within the county can differ quite a bit for instance the city of Dallas is about 285 with more than half of that coming from school districts. Dallas TX currently has 986 tax liens available as of February 10. Payroll taxes in Texas are relatively simple because there are no state or local income taxes.

The average tax rate in Dallas County is about 199. However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas. Each county tax sale list is located differently.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. The 2018 United States Supreme Court decision in South Dakota v. Check out Back Taxes Dallas.

The Texas sales tax rate is currently. Taxes leading to foreclosure can include property taxes city taxes hospital taxes and school taxes as well as city liens placed against the property by the city. Only the Federal Income Tax applies.

Ad A Rated in BBB. Get Your Tax Options With a Free Consultation. This program is designed to help you access property tax information and pay your property taxes online.

Texas Tax Back is located on the third floor and offers certain tax refunds on items bought. What happens when you buy a tax lien. This is the total of state county and city sales tax rates.

The Dallas County Tax Office is committed to providing excellent customer service. The rate increases to 075 for other non-exempt businesses. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable servicesLocal taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Dallas like much of the south was defined by slavery in the 1800s. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023.

The information provided by independent websites government websites local papers and services varies greatly. Texas has no state income tax. While Texas statewide sales tax rate is a relatively.

The County sales tax rate is. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Dallas TX at tax lien auctions or online distressed asset sales. Get Your Free Tax Analysis.

Wayfair Inc affect Texas. Trusted Reliable Experts. Records Building 500 Elm Street Suite 3300 Dallas TX 75202.

Contact the Customer Care Center at 214-653-7811 Monday through Friday from 800 am. The Dallas sales tax rate is. In Texas a property cannot be sold at a Sheriffs sale or Constables Sale without first being advertised in a local paper for three consecutive weeks.

Texas tax back dallas. Analysis Comes With No Obligation. This marginal tax rate means that your immediate additional income will be taxed at this rate.

We are proud to provide a selection of tax advisory services. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. The minimum combined 2021 sales tax rate for Dallas Texas is.

Looking for Tax Experts in Dallas TX. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Texas is one of seven states that do not collect a personal income tax.

Tax Free Shopping Southlake Tourism Tx Official Website

Collecting Past Due Child Support In Texas Frisco Family Lawyer Collin County

Galleria Dallas Tax Free Shopping

Professional Income Tax Services In Dallas Tx Tax Services Income Tax Tax Preparation

Tax Return Services Tax Refund Outing Quotes Good Credit

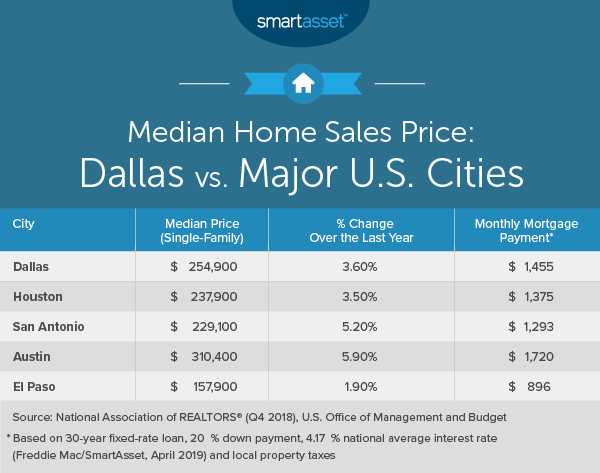

Cost Of Living In Dallas Smartasset

Texas Sales Tax Small Business Guide Truic

![]()

Dallas And Northeast Texas Chapter

How To Charge Your Customers The Correct Sales Tax Rates

New Tax Law Take Home Pay Calculator For 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Electric Company Dallas Tx Electricity Rates In Dallas Direct Energy

Morgan Meyer Morganmeyertx Twitter

Get Income Tax Services In Dallas Tx From Experts Tax Services Income Tax Income Tax Service

Why Are Texas Property Taxes So High Home Tax Solutions

When Tax Returns Are Not Filed If You Are Seeking Help Filing Current Tax Returns The Team Of Tax Professionals At Our Firm C Tax Return Tax Help Tax Attorney